Twyp cash mercadona

Ing atms

The operation is simple. With this service you can withdraw cash at the same time as you make a purchase in the aforementioned stores. There is no minimum purchase amount, although withdrawals are limited:

Since Banco Popular was acquired by Banco Santander, ING customers have been concerned about what would happen to the bank’s ATMs that they could then use free of charge. And is that the president of Santander, Ana Botín, has already announced to customers and the orange entity that, from 2018, Popular ATMs would no longer be available.

We help you choose the account with the lowest commissions, the loan or mortgage with the lowest interest, the most profitable deposit or the real estate to sell your apartment. We provide tips, advice and calculation tools, all completely free of charge.

Bizum ing

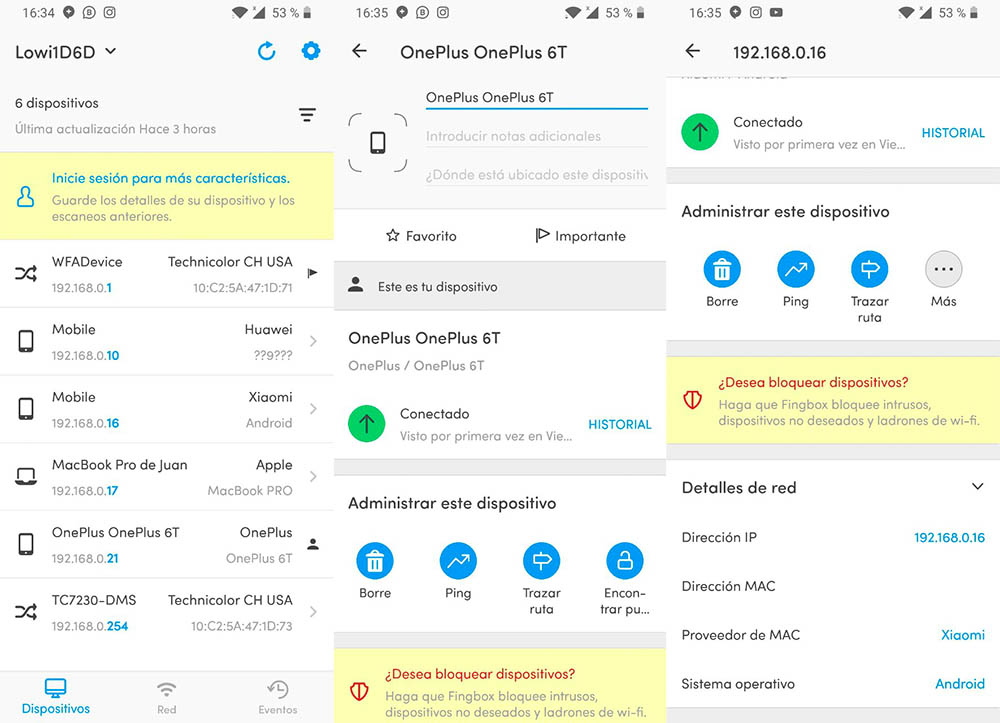

ING’s application is totally secure and guarantees the privacy of each and every payment. Each payment is checked and verified in accordance with international regulations. In addition, for added security, we will always have to approve the payment with our PIN or fingerprint.

We help you choose the account with the lowest commissions, the loan or mortgage with the lowest interest rate, the most profitable deposit or the real estate agency to sell your apartment. We provide tips, advice and calculation tools, all completely free of charge.

Ing credit card

Not only Dia would participate in this service, since ING has included the Galp and Shell gas stations, so that it achieves in one go more than 3,500 points for its customers to have ‘ATMs’ (they can withdraw a maximum of 1,000 euros per month). Although the service is being pioneered by Dia, it is not exclusive and is open to other retail chains. Similarly, Currás has raised the possibility that other banks may approach Dia to agree on a similar collaboration.

Bnext

Bizum, for immediate account-to-account payments, is the big bet in the sector. With just three months of operation, it has more than 300,000 users and 15 million euros in 338,000 transactions. The platform integrates 26 entities, representing 95% of the market. «It will soon converge with a similar initiative on a European scale,» says Miguel Ángel Prieto, director of banking and insurance business development at Tecnocom.

It will also depend on regulation, which is lagging behind in most cases, the incorporation of terminals with fingerprint recognition and NFC communication capabilities (which allows contactless payment at less than 30 centimeters) and greater consumer awareness and confidence. All in all, the online medium is more secure than the physical one. «It is much more difficult to hack an electronic system; it even alerts to theft,» says mobile marketing professor Javier Rodríguez.